Economic downturns are detrimental to states’ capacity to make key public investments. Downturns bring pressure on governments for additional spending to help people who are struggling – especially for services such as Medicaid, housing, and energy assistance – at the very time that falling personal income and reduced economic activity hurt revenues. The 2008 recession, which spanned December 2007 through June 2009, was the longest and deepest national downturn since the Great Depression and, New Jersey, like most states, saw record year-over-year declines in all major state tax revenue sources.26

States met the damaging effects of the 2008 recession through a four-pronged response:

- Drawing down such reserves as “rainy-day funds” and year-end surpluses

- Cutting spending

- Raising taxes and other revenues

- Using stimulus assistance from the federal government’s American Recovery and Reinvestment Act of 2009

Still, these actions served to reduce, not eliminate, the pains of the 2008 downturn. And New Jersey’s financial problems, which both preceded and outlasted the downturn, only made things worse.

It took seven years for the state’s gross income tax to return to its previous peak, and six years for the general sales tax to do so. The corporate business tax has not, even today, returned to its pre-recession peak. And the remaining tax revenues also remain below pre-recession levels. Recession-induced spending, which has not yet declined to pre-recession levels, would have to be added to these data to get a complete estimate of the total size of the cyclical deficit. Yet, it is clear that the 2008 recession significantly harmed New Jersey finances.

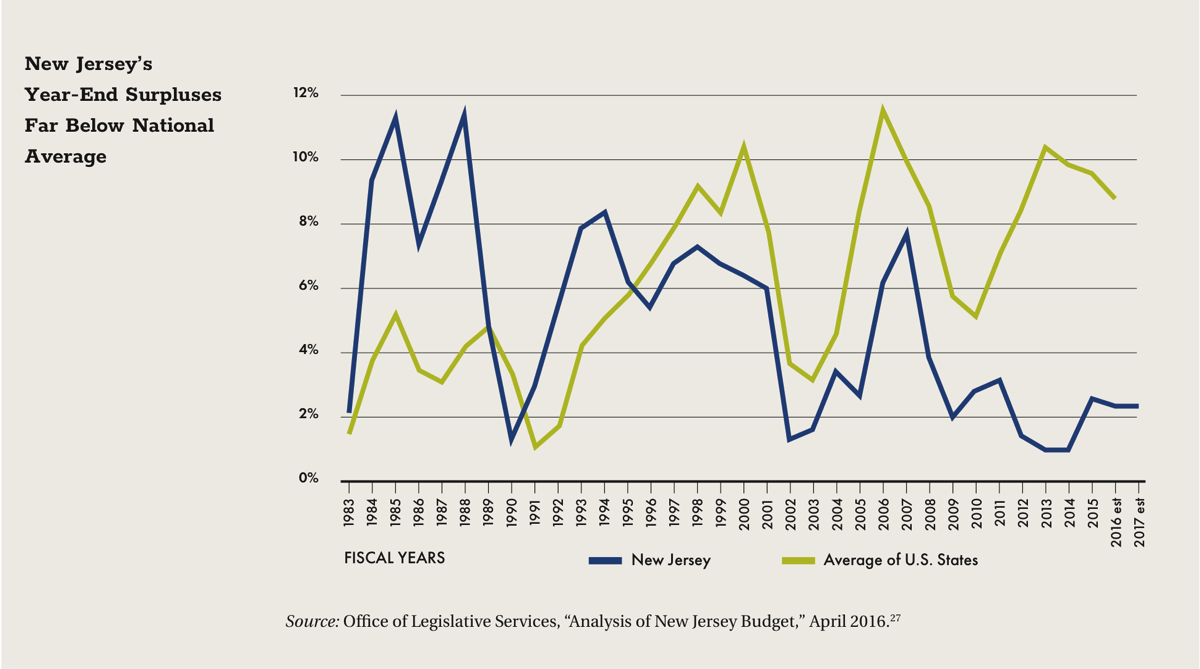

The country has experienced an economic downturn each decade since World War II and many economists fear that another one will occur soon. If it did, the strategies that states employed to deal with the 2008 downturn might not be available. States have yet to replenish their reserves, especially their rainy-day funds, the money set aside for emergencies. As the following chart shows, New Jersey’s end-of-the-year budget surpluses and rainy-day reserves are near a 25-year low and are significantly below the average for all states as a percentage of spending.

Similarly, many public finance experts feel that the federal government is unlikely to provide another stimulus in view of its own fiscal problems. Under current conditions, the policy response to another economic downturn would prove quite challenging for New Jersey. Another downturn could bring cuts in core services and could require significant tax increases.

RECOMMENDATION

Replenish the state rainy-day fund.

The rainy-day fund provided some cushion against the initial need for spending cuts and tax increases during the recession and should be restored. This effort should include a review of best practices in other states and a review of New Jersey’s provisions regarding the level of reserves to be maintained and the conditions under which they can be drawn down. Building a rainy-day fund is good public policy and can prepare the state for cyclical downturns.